The Single Strategy To Use For Kam Financial & Realty, Inc.

The Single Strategy To Use For Kam Financial & Realty, Inc.

Blog Article

All About Kam Financial & Realty, Inc.

Table of ContentsThe Facts About Kam Financial & Realty, Inc. RevealedThe Ultimate Guide To Kam Financial & Realty, Inc.The 9-Minute Rule for Kam Financial & Realty, Inc.The Basic Principles Of Kam Financial & Realty, Inc. Get This Report on Kam Financial & Realty, Inc.Some Known Incorrect Statements About Kam Financial & Realty, Inc.

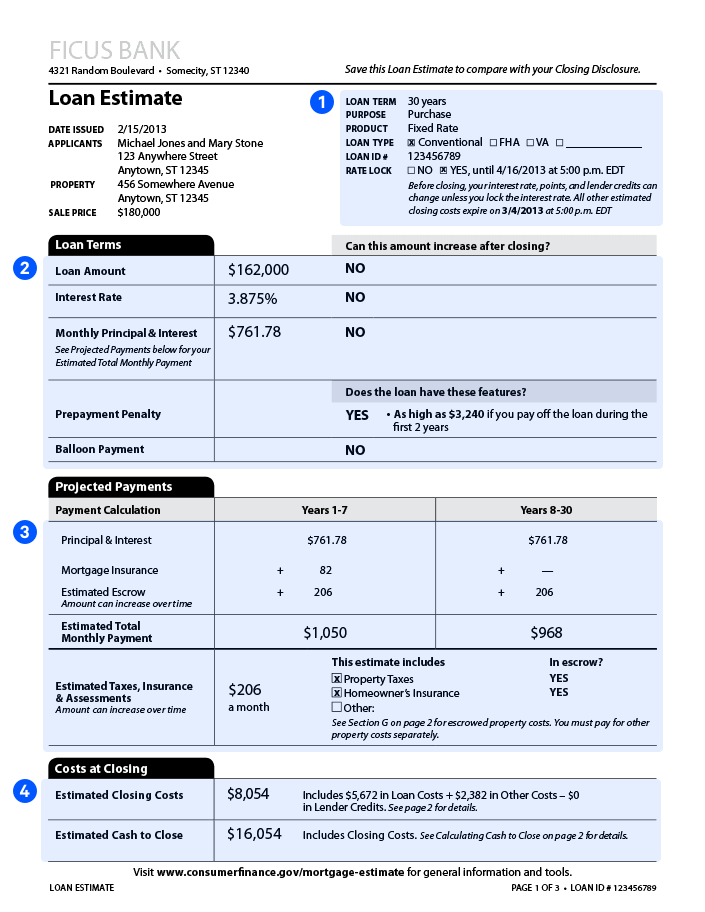

A home loan is a car loan used to purchase or keep a home, plot of land, or other real estate. The customer consents to pay the lender with time, commonly in a series of regular payments divided right into major and interest. The residential property after that acts as collateral to safeguard the car loan.Home loan applications go through a strenuous underwriting procedure before they reach the closing phase. The home itself serves as collateral for the car loan.

The cost of a home mortgage will rely on the kind of car loan, the term (such as three decades), and the rates of interest that the loan provider charges. Home loan prices can vary commonly depending on the sort of product and the credentials of the candidate. Zoe Hansen/ Investopedia People and companies utilize home loans to get genuine estate without paying the entire acquisition cost upfront.

About Kam Financial & Realty, Inc.

Most conventional home mortgages are totally amortized. This suggests that the routine repayment quantity will remain the very same, however different percentages of major vs. interest will certainly be paid over the life of the lending with each payment. Typical home mortgage terms are for 15 or three decades. Home loans are likewise called liens versus home or claims on residential or commercial property.

A domestic homebuyer promises their house to their loan provider, which after that has a case on the residential or commercial property. In the case of foreclosure, the loan provider may kick out the citizens, sell the building, and utilize the cash from the sale to pay off the home loan financial debt.

The lender will ask for evidence that the customer is capable of paying off the lending. https://kam-financial-and-realty-inc.jimdosite.com/., and evidence of current employment. If the application is authorized, the lending institution will supply the customer a funding of up to a particular amount and at a specific passion price.

Kam Financial & Realty, Inc. - The Facts

Being pre-approved for a mortgage can offer purchasers an edge in a tight housing market due to the fact that vendors will certainly recognize that they have the cash to support their offer. As soon as a customer and vendor settle on the regards to their offer, they or their agents will meet at what's called a closing.

The seller will certainly move ownership of the residential property to the customer and obtain the agreed-upon sum of money, and the purchaser will sign any type of staying home loan records. The loan provider might charge fees for coming from the loan (occasionally in the form of factors) at the closing. There are numerous choices on where you can get a home loan.

Excitement About Kam Financial & Realty, Inc.

The common type of home loan is fixed-rate. With a fixed-rate home mortgage, the rates of interest stays the very same for the whole term of the loan, as do the borrower's month-to-month payments toward the home mortgage. A fixed-rate mortgage is likewise called a standard home mortgage. With an adjustable-rate home loan (ARM), the rates of interest is taken care of for a first term, after which it can alter regularly based upon dominating rate of interest prices.

The 7-Second Trick For Kam Financial & Realty, Inc.

The whole financing equilibrium becomes due when the customer dies, relocates away permanently, or sells the home. Within each sort of mortgage, borrowers have the choice to get discount rate points to acquire their rate of interest rate down. Points are essentially a cost that borrowers compensate front to have a reduced rates of interest over the life of their lending.

The Ultimate Guide To Kam Financial & Realty, Inc.

Just how much you'll need to pay for a home mortgage relies on the kind (such as fixed or flexible), its term (such as 20 or 30 years), any kind of discount factors paid, and the rate of interest at the time. mortgage loan officer california. Rates of interest can vary from week to week and from lender to loan provider, so it pays to search

If you default and foreclose on your home mortgage, nonetheless, the bank might become the new owner of your home. The rate of a home is typically much higher than hop over to here the amount of cash that a lot of houses save. Because of this, mortgages allow individuals and family members to buy a home by taking down just a relatively tiny deposit, such as 20% of the acquisition rate, and obtaining a lending for the equilibrium.

Report this page